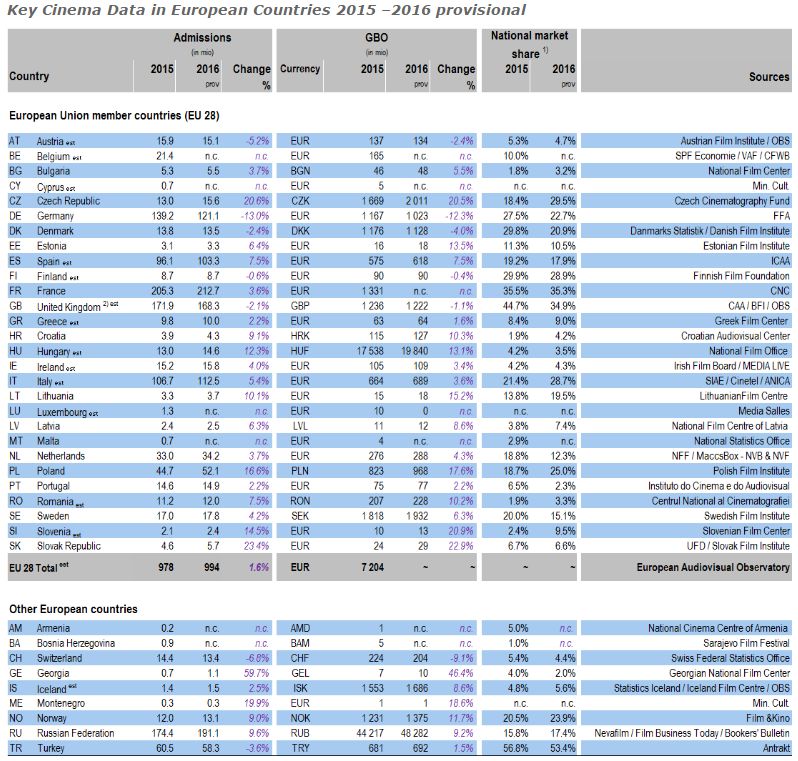

2016 marked by excellent cinema attendance within the European Union; Croatia sets new record

At the 67th Berlin International Film Festival, the European Audiovisual Observatory released its first estimates for European cinema attendance. Initial results show that the sale of cinema tickets continues to grow, with 996 million being sold in 2016, a 1.6% increase from 2015, or, 16 million more admissions. 2016 was also a record year for Croatian cinemas: For the first time since the country’s independence, the number of admissions rose to over 4 million (nearly 4.3) and the ratio of admissions to population is also, for the first time, 1:1.

This is the best result since 2004. Including admissions sold outside the European Union, the total number of sales in 2016 rose to over 1.27 billion which is the highest number of tickets sold in the last decade.

The number of admissions within the EU increased in 19, and decreased in only 5 of 24 member states. The countries with the highest ticket sales were France (more than 7.4 million), Poland (more than 7.4 million), Spain (more than 7.2 million) and Italy (more than 5.8 million). The Czech Republic achieved fantastic results with more than 2.7 million admissions sold (more than 20% increase) while Slovakia saw an increase of more than 23% and 1.1 million tickets sold. 2016 was also a record year for Croatian cinemas: for the first time since its independence, nearly 4.3 million admissions were sold making the ratio of admissions to population 1:1. The table shows an increase of 9.1% compared to 2015, while the increase of Croatian films in cinemas rose 4.2% in comparison to 1.9% in 2015. Only two countries saw a significant decline in admissions: Germany and England.

Outside the EU, the Russian market jumped by 9.6% to 191 million after three years of stagnating admission levels. This is the highest level achieved in recent history and further strengthens Russia’s position as the second largest European market in terms of admissions. Turkey, the sixth largest European cinema market, saw its admissions declining for the second year in a row with cinema attendance falling by 3.6% from 60.5 million to 58.3 million tickets sold. Norway on the other hand registered the highest cinema attendance in 40 years with admissions increasing by 9% to 13.1 million.

Admissions growth probably driven by solid performance of US studio and selected national titles

Although it is too early to analyse EU admissions by origin, it seems that the fact that cinema attendance in the EU could not only maintain but actually exceed the exceptionally strong 2015 level is essentially due to the solid performance of a comparatively large number of US studio titles along with strong results for Italian, French, Polish and Czech films in their home markets. In contrast to 2015 when Star Wars VII, Minions and Spectre stood out selling around 38 million tickets in the EU each, no single film seems to have generated more than 30 million admissions in 2016. Top ranking films in the EU include animation films such as The Secret Life of Pets, Finding Dory, The Jungle Book and Zootopia as well as Fantastic Beasts and Where to Find Them, Rogue One: A Star Wars Story, Star Wars VII, Deadpool and Captain America: Civil War.

Compared to 2015, national market shares of EU films increased in 11 and declined in 13 of the 24 EU markets for which 2016 data were available. France was once again the EU market with the highest national market share (35.3%) closely followed by the UK (34.9%), the Czech Republic (29.5%), Finland (28.9%) and Italy (28.7%). Looking outside the EU, Turkey confirmed its leading position in terms of national market share with Turkish films capturing 53.4% of admissions in 2016.

1) Based on admissions except for GB and IE where it is based on GBO. Includes minority co-productions with the exception of CH and DK.

1) Based on admissions except for GB and IE where it is based on GBO. Includes minority co-productions with the exception of CH and DK.

2) National market share for UK qualifying films based on GBO in the UK & Ireland up to and incl 22/01/2017, includes minority co-productions and US studio backed films.

Source: European Audiovisual Observatory

Notes:

Data have been collected with the collaboration of the EFARN (European Film Agency Research Network).

All 2016 figures are provisional.